DePIN: Market-Fit And Life Beyond Speculation

Recently, we saw several DePIN projects emerge and dominate media and discussions on web3. Some say that it is the ideal sector to attract web2 users, others say that it is the sector where web3 projects will replace big techs. However, to achieve these expectations, these projects will have to, above all, find themselves in the market and grow sustainably.

Recently, we saw several DePIN projects emerge and dominate media and discussions on web3. Some say that it is the ideal sector to attract web2 users, others say that it is the sector where web3 projects will replace big techs. However, to achieve these expectations, these projects will have to, above all, find themselves in the market and grow sustainably.

To better understand the scenario, we can divide these projects into 2 main categories: projects that decentralize physical resources and projects that decentralize digital resources. Let’s dive deep and show each of them.

Projects that decentralize digital resources

These projects generally focus on decentralizing digital resources from people’s physical devices, such as:

- Filecoin and Arweave (Storage)

- Render, Akash, TAO, and IO.net (Computational power)

- Grass, Theta, and Livepeer (Bandwidth)

As you can see, the biggest DePIN projects are on this list, and this is no accident. They operate in sectors that already move billions of dollars and grow every year. However, being in this sector also presents the biggest challenges for them.

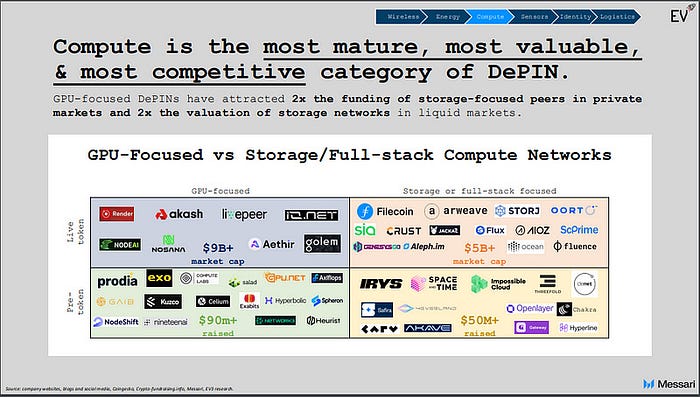

Press enter or click to view image in full size

Source: Messari

First, the dominant players here are Google, Microsoft, and Amazon, the largest companies on the planet, which makes it difficult to grow their market share in this sector. Second, due to their decentralized nature, the operation of these projects becomes much more complex, needing to deal with several other technical obstacles such as latency, greater difficulty in scaling, and greater work in orchestrating network resources and nodes. Meanwhile, centralized companies already have a highly scalable, efficient, and, above all, truly TESTED structure.

Despite the technical challenges, this category was by far the most benefited by the rapid expansion of demand for AI and data analysis. With the scenario showing an increasingly promising market, these projects can still have very high growth. Furthermore, many of these projects are already able to offer these services more cheaply than centralized services, but still without the entire ecosystem, tooling, and maturity of centralized services.

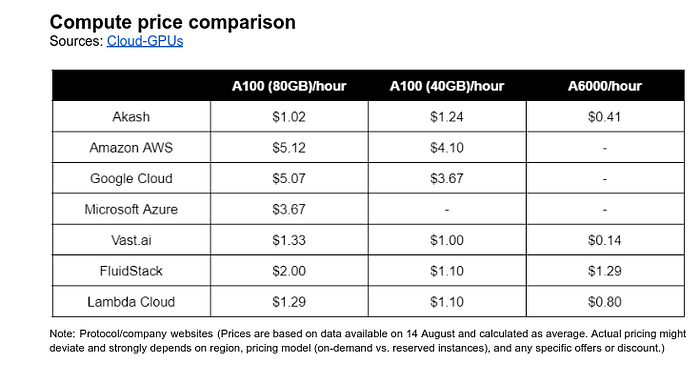

Press enter or click to view image in full size

Source: MV Capital

Akash, for example, has already shown itself to be a viable product at a much lower price than centralized projects, consolidating itself as an outlet for certain projects. Stargaze, Rango Exchange, and Osmosis, for example, have already deployed using it.

Another narrative that could also drive these projects is possible censorship, abuse of power, or any form of oppression by centralized operators, which would make people seek decentralized solutions. An example of this concern about centralization is the constant debates about the centralization of Ethereum nodes.

Projects that decentralize physical resources

These projects generally focus on decentralizing data from physical parts like :

- Helium, World Mobile (Connectivity)

- Hivemapper, DIMO, Natix (Sensors)

As you may have noticed, almost all projects here have a relatively smaller market capitalization and are less well-known. This is largely because they generally operate in very specific areas, especially those that use sensors. However, projects in this category have a very strong differential: DISTRIBUTION.

Imagine the work a company would have to do, for example, to place sensors in every corner of the world to record noise or the work Google has to do to map every place on the planet and do it frequently to keep itD updated. With all this cost and work, this form of mapping has already proven to be not that efficient.

Do What They Can’t And Reach Where They Can’t

Billions of people like you and me already walk around with several sensors and data capture devices every day, and most importantly, we are geographically distributed. And that is where DEPIN can perhaps really stand out, not by competing to do the same things as big techs, but by using decentralization and distribution to do what big companies cannot do, and reach places they cannot reach.

This approach can open a path to several opportunities, such as reaching places that are difficult for large companies to access, or meeting specific uses such as a temporary “network” between devices in an isolated region or affected by some tragedy, and even a network of cell phones communicating to create a privacy network for data exchange.

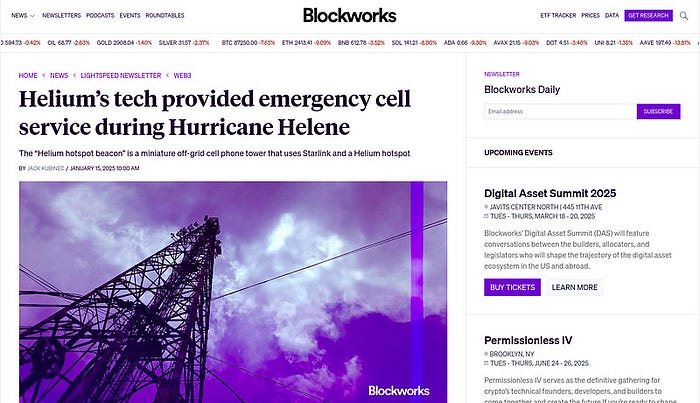

A recent example was how Helium Mobile provided access to people affected by the hurricane in North Carolina, connecting with Starlink satellites and generating a network with mobile data and radio signals in the region.

Press enter or click to view image in full size

Source: Blockworks

A path that seems to be increasingly viable is a greater relationship between “centralized” projects with new DEPIN projects, where these use their distribution and decentralization to reach places where the centralized structure has difficulty reaching or providing service in some specific use case.

The Speculation

Due to their potential and possible “ease” of adoption, projects in this category start to have very high speculation. At first, this seems great, the project gains visibility, attracts many users, its metrics grow exponentially, and even raises more capital in investment rounds.

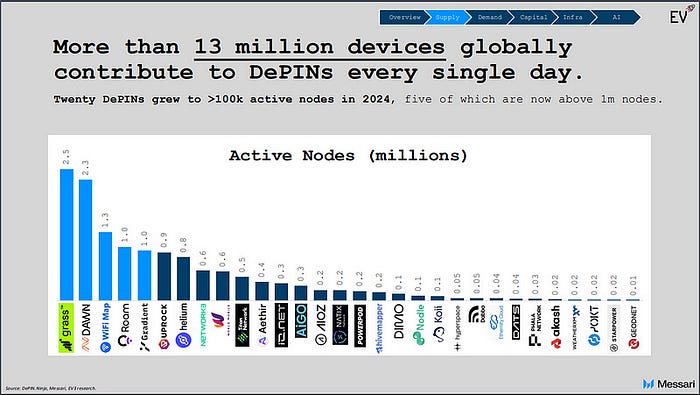

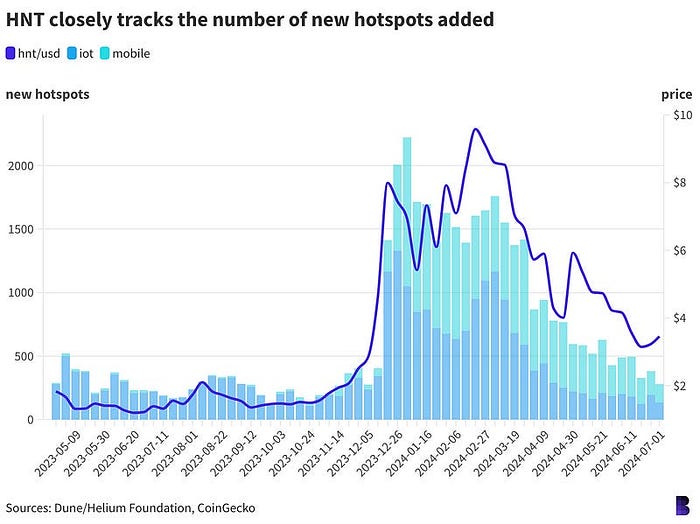

Press enter or click to view image in full size

Source: Messari

However, if we take the 5 projects with more than 1m nodes mentioned above, they all had active airdrop campaigns in 2024 (with some still running today). In projects where their tokens have already been launched, the biggest incentive for new providers is still the token price appreciating.

Press enter or click to view image in full size

Source: Blockworks

The Life Beyond The Speculation

It is from this point on, that DePIN may find its main challenge in this market. Amidst so much speculation about airdrops, incentives, often inflated numbers, and even “mercenary” capital, projects need to find a way to be a truly sustainable BUSINESS in the long term.

For these projects to survive in the long term, they need to make the entire operation financially viable, and they need to solve a major challenge: How to make the user more interested in running that infrastructure and participating in the network, rather than just buying the token and speculating, or even just farming a possible airdrop?

It’s All About Tokens

Tokenomics in DePIN projects is quite complex and a bit tricky, mainly because DePIN has a very particularity compared to other categories: their costs and revenues are in FIAT. This can be quite challenging for projects to model their economy, but on the other hand, it can also attract a larger number of investors beyond the web3 world.

The first projects that emerged in this sector suffered in the past since the approach, in the beginning, was quite focused on just distributing tokens to users. However, when the boom of 21 came, for example, these payments started to become quite high, with the provider’s cost remaining fixed and in FIAT, which made projects spend too much on rewards in the high and lose providers in the low.

Since then, several projects have been struggling to find the best possible economic model to ensure that their tokens can truly capture value in the long term. Projects are still trying different ways to give utility to these tokens. We have already seen several utilities being consolidated:

Token For Payments

The first and more “obvious” one that projects have adopted. The idea here is that if you make payment for services in tokens, you theoretically generate more demand for it. However, because consumers can buy the token, and providers who receive it can sell it immediately, this has not yet translated 100% into demand in some projects.

Furthermore, DePIN projects, as we have mentioned a few times, target web2 consumers a lot, and they have to deal with the “barrier” of needing to set up a wallet and buy tokens, which makes the experience difficult and reduces adoption.

Token For Rewards

The most tested and used in all projects; however, just because you use rewards, it doesn’t mean that these rewards need to be the same; each project needs to adapt this model to suit its needs. For example, projects like Render need to give rewards for making their GPU available online, and others like Hivemapper, for mapping certain streets (some may have more priority than others).

In this model, you already guarantee the supply side in advance, being able to prove to future consumers that the network can meet their needs. However, because it is an old model and the most used, the problems faced are also old. Remember the problems the first DePINs projects suffered? Most of them came from problems in the way these tokens were given as rewards.

How can these rewards be calibrated in a healthy way? How to increase providers without diluting rewards? What if the token price drops too much? Furthermore, how can these rewards be measured based on the FIAT costs that providers will incur and generate more predictable returns on their operations? One path that seems to be gaining traction is a much stronger relationship between these token rewards and FIAT values. This reduces unpredictability for providers and generates operational viability regardless of whether the market is bullish or bearish.

Buy and burn

Here, the project takes a portion of its revenue generated on the network, buys tokens on the market, and burns them, creating a good relationship between network revenue and demand for the token. What varies a lot here from project to project is the percentage of revenue that is used for burning, and whether this percentage remains fixed over time or varies for some specific reason.

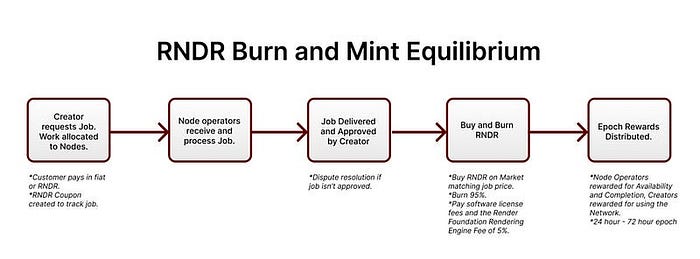

Burn and Mint Equilibrium

Similar and almost following the same “philosophy” behind Buy and Burn, here, the price that users pay is already priced in fiat and converted into tokens; to access the service, they “buy” these tokens and then burn them. The main difference between Buy and Burn is on the provider side, where the network has a token issuance already programmed and transparently for each period, and these new tokens are then divided proportionally to the work that each provider had during the period. A project that adopted and generated a lot of relevance for this model was RENDER.

Press enter or click to view image in full size

Render Whitepaper

This method has proven to be very useful so far, especially for marketplaces, since in the Buy and Burn model, the value is very much tied to the token and “locked” into the protocol. With the addition of the token issuance feature on the other side of the operation, operators earn a reward in tokens, proportional to their work during that period. As you can imagine, this does not generate as strong a demand for the token as in the buy and burn method, but on the other hand, it generates a greater balance (as the name suggests) between supply and demand, without forgetting the providers.

Tokens For Stake And Governance

Less used than others, some specific DePINs offer the possibility of staking their tokens, creating an economic disincentive for providers to misuse the network, and generating more trust in the services.

The Key is How You Distribute The Tokens

There are several formats for giving utility to tokens, and this does not mean that a project needs to adopt only one method, since each project has its own needs and operations, but we can already draw some conclusions about trends in this market:

- Rewards need to be structured based on the cost that providers will incur to participate in the operation.

- Projects have realized that they need to calculate the economics of their processes based on FIAT, and even if they continue to pay their users in tokens, this calculation needs to have a FIAT base to remain healthy and not be vulnerable to greater market volatility.

- Everyone finds it difficult to maintain a stable rewards program that attracts true providers and not just speculators.

- If people prefer to buy and hold your tokens, rather than receive them as a reward for participating in the network, your token model is probably bad.

- Rewards will always be the main point, but even more important than the rewards themselves is how those rewards will be distributed.

- A large portion of potential consumers of DePIN project services are web2 users, which makes things like token volatility and using a wallet to pay for services a major barrier to adoption.

- Traditional investors are increasingly interested in this sector, and to attract them it will be necessary to show a good token model and its relationship with real revenue.

Conclusion

DePIN projects are a very specific sector of the market, with several peculiarities, which means that an approach for one may not necessarily work for another. The big difference here is how this sector is affected by distribution.

Depins revolve around their distribution and flexibility, whether it’s geographically distributed users with mobile phones in our country, video cards in homes around the world, or devices in cars on highways. The question here is how projects approach and deal with this; the way each project positions itself in the market is what will tell how this will affect the operation.

DePIN projects that decentralize digital resources such as GPU and CPU marketplaces can benefit from this highly valued and exponentially growing sector, but will “suffer more” by having to compete with big techs and deliver infrastructure on the same scale, and dealing with the technical difficulties that decentralization will bring to synchronize and also improve operations. However, for certain purposes, decentralized projects can already serve well and at a very interesting price.

On the other hand, projects that decentralize physical resources will have a relatively easier path because they benefit greatly from this distributed structure of people and devices, being able to differentiate themselves and even do things that centralized companies cannot. Here we can glimpse an even stronger connection between web2 and web3, since here, they can complement each other and not just compete. However, because they operate in more specific cases, this sector does not have the same market capitalization or the same growth rate.

In terms of economics, projects have almost unanimously adopted the stance of measuring and structuring their operations based on FIAT, providing more predictability for both providers and consumers. They understand that the cost of all provider operations is in FIAT, and dissociating this from rewards creates several economic distortions.

Economies and sustainability are the Achilles heels of these projects. All of them will have a tough mission to find a balance between the strong initial speculation they suffer and the construction of a solid base of providers and services that can sustain itself and not only last for the duration of an airdrop campaign. In the beginning, DePIN projects need this “speculation” to gain attention, users and achieve initial traction, but in the long term, they need to be “shielded” from speculation and great volatility if they want to survive in the long term.

Operating on the network needs to be financially viable and more attractive than just holding the token, and the biggest test for this will be TIME. If after setting up the entire operation, providers can cover all their costs (energy, devices, internet, etc.), make a profit, and the final product generated by these various providers is competitive, then perhaps we will have a real BUSINESS and not just another DePIN project.

Published in Journal of Blockchain Research

DOI: 10.1000/xyz123